Colorado added 12,400 jobs in August—the largest amount since April 2022. However, July’s employment estimate was revised down by 300 jobs, bringing the prior month’s growth to 1,900 jobs. Government employment declined by 2,100 jobs in August whereas the private sector added 14,500. The sectors of Leisure and Hospitality and Education and Health Services both grew by more than 3,000 jobs, while the sectors of mining and logging and financial activities declined.

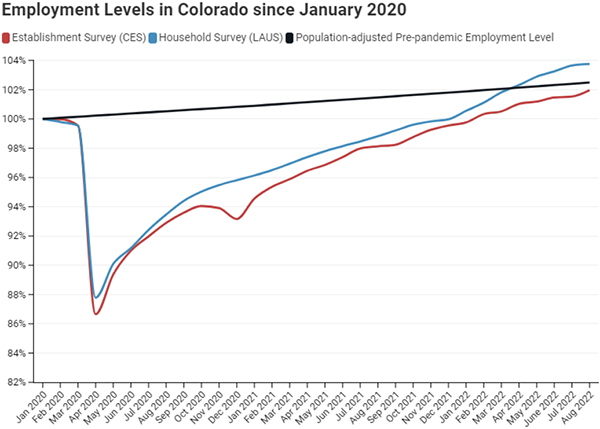

Leading into August there was a growing discrepancy between the survey trends in employment growth compared to the number of Coloradans employed. Though the gap shrank this month, the employment to population ratio still lags pre-pandemic levels. The cause of the growing discrepancy between the two surveys is still uncertain, but it may be that there has been a significant structural change within the job market.

Key Findings—Colorado August 2022 Employment Data (BLS CES Survey and LAUSi)

- Colorado added 12,400 total nonfarm jobs in August

- Private sector jobs increased by 14,500 while government jobs declined by 2,100

- July job growth was revised downward from a gain of 2,200 to 1,900 jobs.

- The total employment level is up 2.0% (67,700 jobs) above its pre-pandemic level, ranking Colorado 8th in terms of August ‘22 job levels relative to Jan. ’20.

- Twenty-two states have employment levels above what they were at the start of the pandemic. Texas has the highest differential (+513,300 jobs).

- Colorado’s employment rate has recovered from the pandemic according to one measure but still falls short according to another.

- According to the BLS survey of the number of jobs (CES), Colorado has yet to recover to a pre-pandemic ratio of employment-to-population

- According to the BLS household survey (LAUS), which captures both traditional jobs and self-employment, the percent of people employed is at its highest level since January 2009.

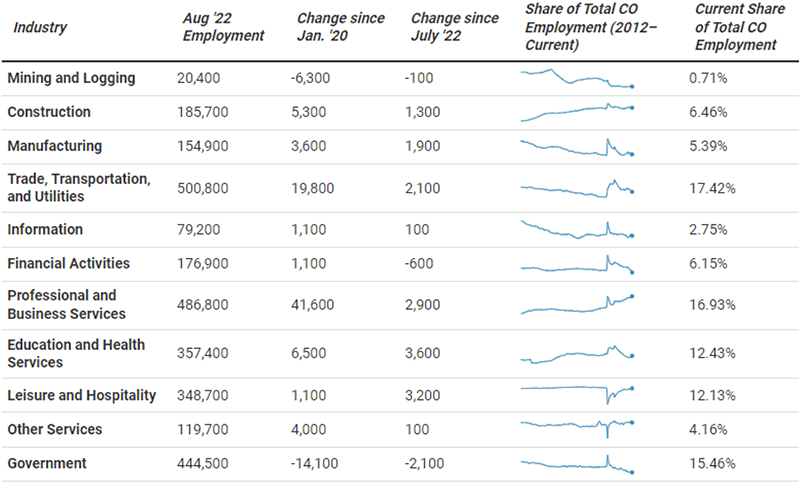

A Deeper Dive into Colorado Industries (BLS CES Survey)

- There was a wide range of job growth across sectors in August.

- The professional and business services industry added 2,900 jobs. The trade, transportation, and utilities industry added 2,100 jobs.

- Financial Activities employment declined by 600.

- Leisure and hospitality industry has led the recovery by adding 82,600 jobs between Jan. ‘21 and Aug. ‘22, yet is only up 1,100 jobs, or .32%, relative to Jan. ‘20.

- Construction is up 3.11% (5,300 jobs).

- Manufacturing is up 2.24% (3,600 jobs).

- The pandemic caused a major shock to the composition of Colorado’s job market in early 2020 and may have induced some structural change in the long run.

- As a share of Colorado’s total employment, the professional and business services sector has grown by 6.9% since the start of 2020.

- The mining and logging sector has declined as a share of state employment by 23.6% since Jan. ‘22, though this is likely the result of a combination of global trends and state policy.

Colorado Labor Force Update

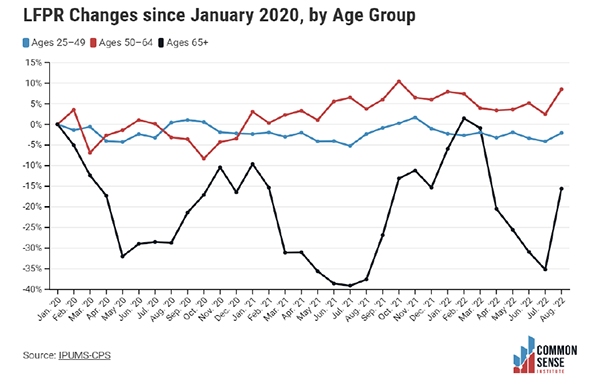

Colorado’s LFPR (labor force participation rate) remained at 69.5% in August; this alongside job growth, especially that indicated by July’s revision, led to a decline in the state’s unemployment rate to 3.4%. The LFPR of retirement-age (65 years and older) workers is now below its pre-pandemic level by 15.6%. After months where retirement age workers were leaving the labor force, their LFPR has increased by 19.63 percentage points since July. This is not surprising as historically these workers re-enter the labor force in late summer/early fall.

Key Findings—Colorado August ‘22 Labor Force Data (FREDii)

- The LFPR remained at 69.5% in August, which is .9 of a percentage point above Jan. ’20’s LFPR of 68.6%.

- The unemployment rate dropped by .1 of a percentage point in August to 3.3%, which is still 0.6 above Jan. ’20’s unemployment rate of 2.7%.

- In August, the LFPR of Colorado women increased from 62.56% to 65.37%. It is now 1.57 percentage points below its pre-pandemic level.

- The national female LFPR fell by .1 percentage points to 56.9%, which is 0.9 percentage points b

elow its pre-pandemic level.

- There are now 35,296 less women in the workforce than there would be if Colorado’s August’s LFPR of women was the same as it was before the pandemic.

Prime-age, Older, and Retirement-age People in the Labor Force

- Since Jan. ’20, the labor force participation rate of all 50–64-year-old workers, regardless of sex, has increased by 8.51%.

- There are 30,519 fewer retirement-age workers in the labor force today than there would be at the pre-pandemic participation rate. After several months of strong recovery, this group’s labor force participation rate has fallen by 4.24 percentage points since March and now sits at 24.44%.

- The LFPR of prime-age workers (25–49) grew by 1.78 percentage points and remains 2.09% below its Jan. ’20 level.