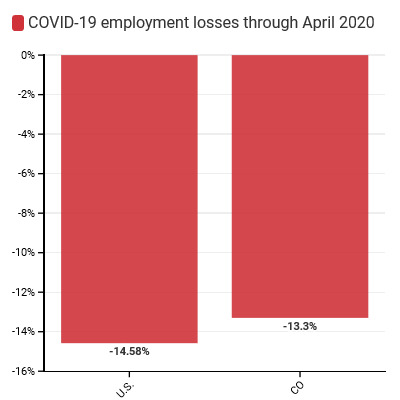

Colorado’s robust economy has added 381,800 jobs since April 2020, eclipsing the 374,500 jobs the state lost in March and April 2020. This represents a recovery rate of 101.9 percent which is 11.5 percentage points higher than the nationwide recovery rate of 90.4. Colorado added 14,100 jobs in February and January’s employment level was revised downwards by 700. February nonfarm employment rose to 2,826,900, which is 5.1% higher than February 2021’s 2,688,700. Colorado’s unemployment rate now stands at 4.0%.

Key Findings—Colorado February 2022 Employment Data (BLS CES Survey[1])

- Colorado added 14,100 total nonfarm jobs in February (a monthly change of .5% for a total year-on-year change of 5.1%).

- In February, for the first time, the state’s employment level is higher than it was before the pandemic.

- To recover to the pre-pandemic unemployment rate of 2.7% by January 2023, Colorado needs to add 6,576 jobs each month, on average.

- Total employment levels are up .3% (7,400 jobs) relative to pre-pandemic levels, ranking Colorado 11th in terms of February ‘22 job levels relative to Jan. ’20.

- Washington D.C. ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 5.3% and 9.5%, respectively.

- Twelve states have employment levels above what they were at the start of the pandemic. Texas has the highest differential (+227,900 jobs).

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in February and others lost

- The trade, transportation, and utilities industry added 2,000 jobs.

- The financial and insurance industry lost 1,400 jobs.

- Though the leisure and hospitality industry has led the recovery by adding 64,400 jobs between Jan. ‘21 and Feb. ‘22, it is still down 17,100 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 11.17% (6,700 jobs).

- Accommodation and food services is down 3.62% (10,400 jobs).

Colorado Labor Force Update

Colorado’s LFPR (labor force participation rate) increased in February to 68.7%, which combined with the strong job growth led to a decline in the unemployment rate to 4.0%. The LFPR of retirement-age (65 years and older) workers is now above the pre-pandemic level by 0.43%. Record high inflation is causing many retirement age workers to re-enter the labor force as they attempt to maintain their standards of living.

Key Findings—Colorado February ‘22 Labor Force Data (FRED[2], and IPUMS-CPS[3])

- February’s LFPR increased slightly to 68.7%, .1 percentage points below Jan. ’20’s LFPR of 68.8%.

- February’s unemployment rate dropped by .1 percentage points to 4%, which is still 1.3 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- In February, the LFPR of Colorado women increased from 64.16% to 64.71%. It is now .57 percentage points above its pre-pandemic level.

- The national female LFPR decreased by .2 percentage points to 56.6%, which is 1.1 percentage points below its pre-pandemic level.

- There are now 13,342 more women in the workforce than there would be if Colorado’s February LFPR of women was the same as it was before the pandemic.

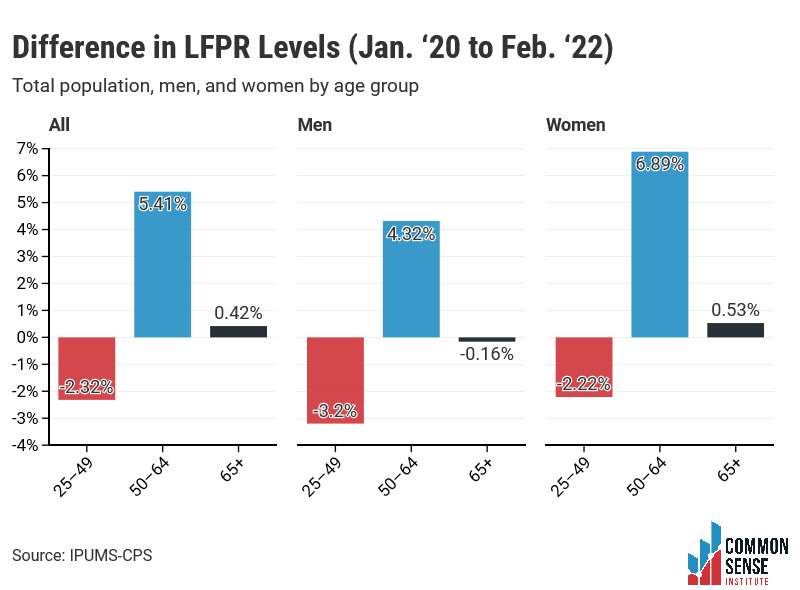

Prime-age, Older, and Retirement-age People in the Labor Force

- Since Jan. ’20, labor force participation rates of all 50–64-year-old workers, regardless of sex, have increased.

- Retirement-age workers had been relatively unwilling to return to the labor force before February, but now participate at a slightly higher rate than they did before the pandemic. There are 3,409 more retirement-age workers in the labor force today than there would be at the pre-pandemic participation rate. Expectations are that, because of record high inflation, older workers are returning to the workforce in some capacity to maintain their standards of living and boost their retirement accounts.

- Of the three age groups, that of people aged 50–64 exhibits the highest LFPR increase since before the pandemic. Prime-age workers, conversely, participate at rates lower than in Jan. ’20.

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://fred.stlouisfed.org/

[3] https://cps.ipums.org/cps/