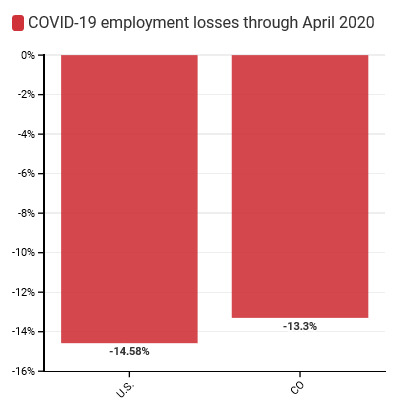

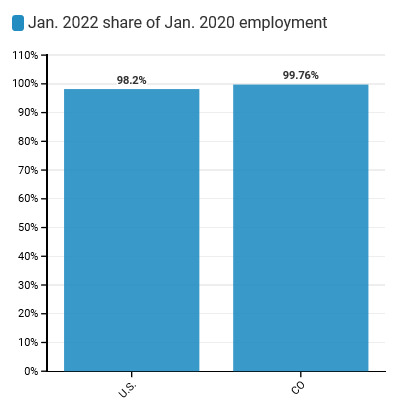

Colorado added 6,700 jobs in January and December jobs were revised upwards by 28,100. January non-farm employment rose to 2,813,500 which is just below that of January 2020’s 2,820,300. Though employment has nearly returned to the pre-pandemic level of January 2020, job growth needs to accelerate for employment to keep pace with population growth.

Key Findings—Colorado January 2022 Employment Data (BLS CES Survey[1])

- Colorado added 6,700 total nonfarm jobs in January (a monthly change of .2% for a total year-on-year change of 5%).

- At this pace, the state would reach pre-pandemic employment levels in April 2022.

- To recover to pre-pandemic employment levels by January 2023—after adjusting for population growth—Colorado needs to add 7,145 jobs each month, on average.

- Total employment levels are down .2% (6,800 jobs) relative to pre-pandemic levels, ranking Colorado 12th in terms of January ‘22 job levels relative to Jan. ’20.

- Vermont ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 5.6% and 10.2%, respectively.

- Ten states have employment levels above what they were at the start of the pandemic. Texas has the highest differential (+131,400 jobs).

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in January and others lost

- The construction industry added 2,000 jobs.

- The arts, entertainment, and recreation industry lost 600 jobs.

- Though the leisure and hospitality industry has led the recovery by adding 64,800 jobs between Jan. ‘21 and Jan. ‘22, it is still down 16,700 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 11.83% (7,100 jobs).

- Accommodation and food services is down 3.33% (9,600 jobs).

Colorado Labor Force Update

Colorado Labor Force Update

Colorado’s LFPR increased in January to 68.5%, which combined with the strong job growth in January lead to a decline in the unemployment rate to 4.1%. The LFPR of retirement-age workers remains nearly 5 percentage points lower than pre-pandemic levels.

Key Findings—Colorado January ‘22 Labor Force Data (FRED[2], and IPUMS-CPS[3])

- January’s LFPR increased slightly to 68.5%, .3 percentage points below Jan. ’20’s LFPR of 68.8%.

- January’s unemployment rate dropped by .7 percentage points to 4.1%, which is still 1.4 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- In January, the LFPR of Colorado women increased from 62.79% to 64.16%. It is now .02 percentage points above its pre-pandemic level.

- The national female LFPR increased by .3 percentage points to 56.8%, which is .9 percentage points below its pre-pandemic level.

- There are now 477 more women in the workforce than there would be if Colorado’s January LFPR of women was the same as it was before the pandemic.

Prime-age, Older, and Retirement-age People in the Labor Force

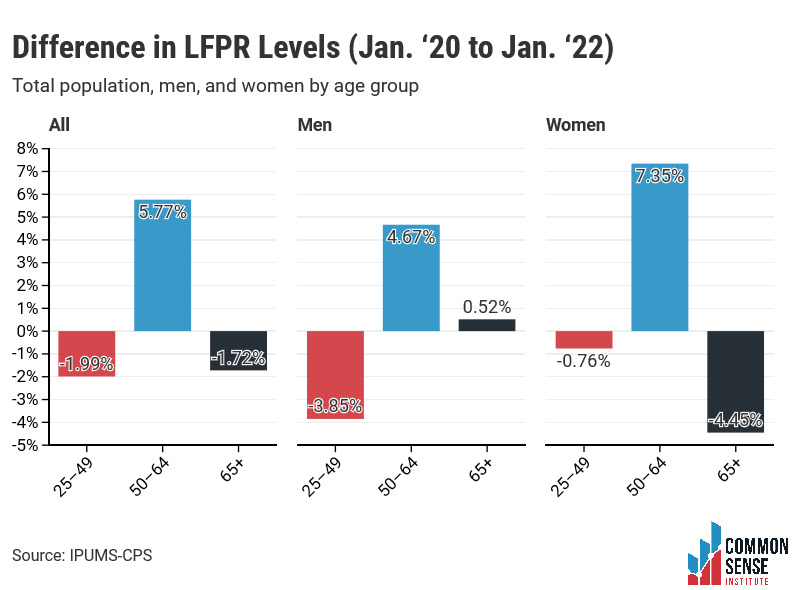

- Since Jan. ’20, labor force participation rates of all 50–64-year-old workers, regardless of sex, have increased.

- Retirement-age workers have been relatively unwilling to return to the labor force; this preference is especially pronounced among women and possibly attributable to the risk of severe COVID-19 infection. There are 15,580 fewer retirement-age workers in the labor force today than there would be at the pre-pandemic participation rate.

- Of the three age groups, that of people aged 50–64 exhibits the highest LFPR increase since before the pandemic. Prime-age workers, conversely, participate at rates lower than in Jan. ’20.

[1]

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://fred.stlouisfed.org/

[3] https://cps.ipums.org/cps/