Introduction

Amid rising prices, regulatory expansions, and large government spending increases, many policymakers and activists are searching for ways to increase Colorado’s affordability. Emboldened by the success of Proposition 116 in 2020, which reduced the state income tax rate from 4.63% to 4.55%, that measure’s sponsors have proposed another income tax cut of almost double its magnitude for the 2022 ballot.

Proposition #121, which would further reduce the state income tax rate from 4.55% to 4.4%, has qualified for the 2022 general election ballot and will receive its official proposition number by September 9

th.

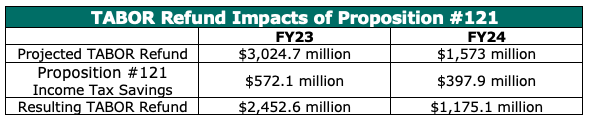

[i] The reduction in the state tax rate would be retroactive for income earned in 2022 and is projected to reduce total state income tax collections over 2022 and 2023 by $572 million.

[ii]

In this report, CSI outlines the details of Proposition #121 and projects the impacts it could have across the Colorado economy upon both the private sector and the state.

Key Findings

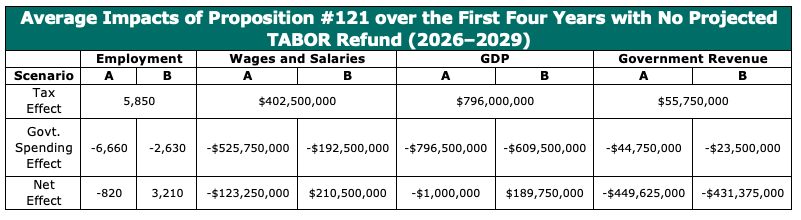

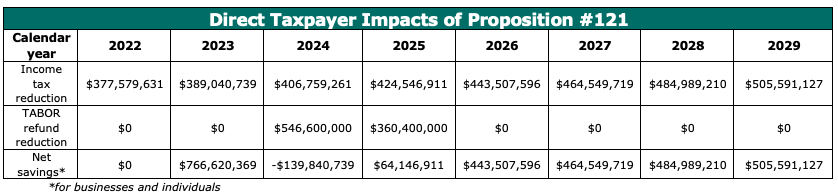

- Proposition #121 would save Coloradans $1.6 billion over the first 5 years after its passage. In 2023, taxpayers would save $767 million, which is more than in any other year—this is because both the 2022 and 2023 tax savings would be realized in 2023 without causing any corresponding reduction in the FY22 TABOR refund, which is already budgeted. In 2024, taxpayers will experience a net tax increase due to the interaction between the 2023 savings and the FY2023 TABOR refund, which would be distributed in 2024.

- Proposition #121 is not projected to reduce state government spending in either of its first two fiscal years because it offsets future TABOR refunds. Over those years, general fund spending is projected to increase by 13.4% from $16 billion to $18.2 billion. In future years with no TABOR refund, the tax cut will lower total revenue available for spending compared to the current baseline but will likely not cause nominal spending reductions between any two years.

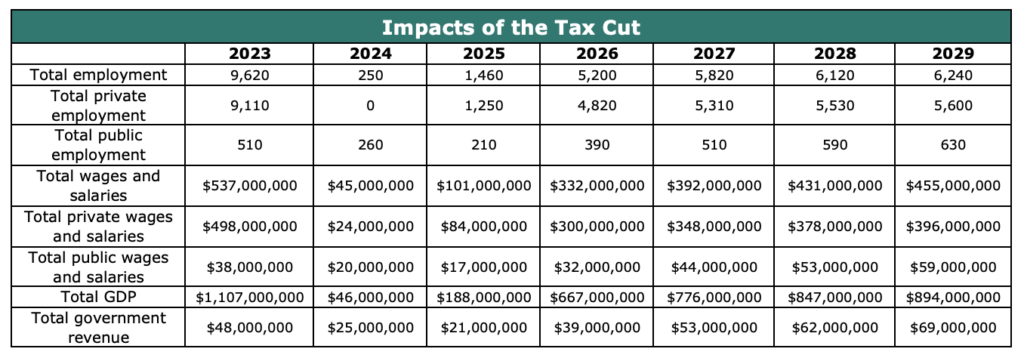

- The largest one-year economic impact of Proposition #121 would occur in 2023, which is the year of the biggest net tax reduction. The dynamic impact of the tax savings in 2023 would be an estimated additional 9,110 jobs.

- Proposition #121 would increase private-sector employment and decrease government employment in the long run. The net impact on employment in 2026, the first year without a projected TABOR refund that the tax cut would offset, depends upon the degree to which the state government manages a smaller budget by reducing the growth in government jobs.

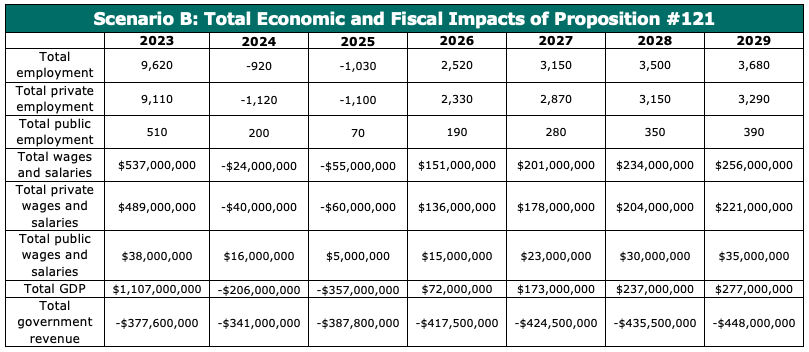

- The state would gain 2,520 jobs under Scenario B, whereby the state government does not cut any jobs and instead constricts spending elsewhere.

- The state would lose 1,590 jobs under Scenario A, whereby the state government cuts its employment to account for the reduction in its revenue.

Background

Current Income Tax Structure in Colorado

Most states have progressive income tax codes and seven do not tax income at all; Colorado is one of nine states which apply a flat income tax rate to residents at all income levels. The state applied a graduated income tax before 1987, at which point the various tax brackets were consolidated into a single rate of 5% due to a bipartisan legislative effort. That rate has since been adjusted down three times: twice due to TABOR provisions and once by Proposition 116, a citizen initiative passed in 2020. The effect of Proposition #121, if passed, would be to reduce Colorado’s current flat rate of 4.55% to 4.4%; the current rate has been effective only since the passage of Proposition 116, before which it had held steady at 4.63% since 2000.

[iii] The income tax regulation in Colorado is inclusive of individual, corporate, fiduciary, and partnership income; this will remain true regardless of Proposition #121’s fate.

Recent Income Tax Changes

Colorado’s income tax rate has not changed since the passage of Proposition 116, but some recent legislation will impact the amount of income tax that Coloradans pay. HB21-1311 increased annual income tax collections by $27.3 million by limiting and ending certain tax deductions. During the latest legislative session, three bills passed which temporarily increase income tax credits and reduce collections by a total of $111.1 million.

Though these recent legislative changes resulted in a short-term effective income tax cut, their impacts upon taxpayers are largely offset by reductions in future TABOR refunds and belie a much more pervasive trend of rising costs—the tax and fee changes approved during the 2021 session alone, for example, raise costs by twice as much as Proposition 116 cut.

Previously, the federal Tax Cuts and Jobs Act of 2017 (TCJA) made several changes to the tax code which have affected the amounts Coloradoans pay in income taxes and the amount Colorado’s government collects in income taxes.

[iv] The Act decreased federal tax rates and expanded some deductions such that most Colorado taxpayers owe less in total than they did previously. It also closed several state- and local-level deductions, causing the state to collect more from taxation than it would have in the absence of federal cuts. March 2018 estimates from the Colorado Legislative Council Staff of the additional revenue to be collected are $748 million in FY23, $878 million in FY25, and somewhat less thereafter due to expiration of most of TCJA’s provisions.

Static Impacts

Below are reported the static fiscal impacts of Proposition #121 upon state revenue as they appear in the measure’s most recent fiscal impact statement, alongside some basic internal calculations of the effects that passage of the measure will have upon personal and business savings.

Static Revenue Impacts

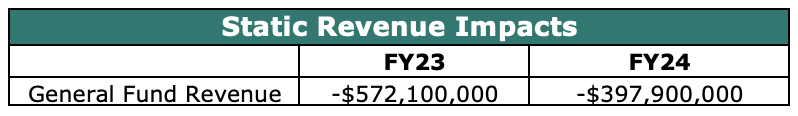

Naturally, the static impact of an income tax cut is a loss of state revenue. In FY24, the most distant year which Proposition #121’s fiscal analysis projects, this impact is a loss of $398 million.

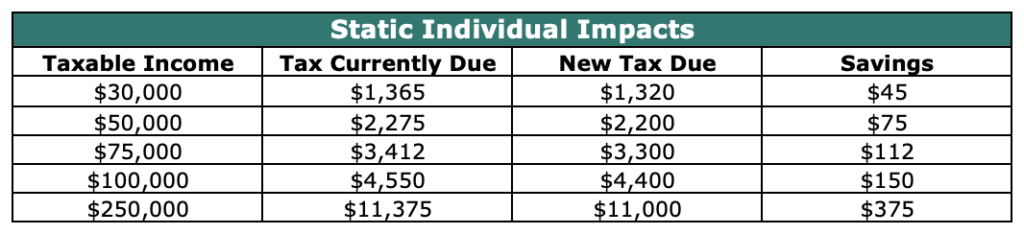

Individual Tax Relief

Individuals who pay income tax will, should Proposition #121 pass, be made to pay less of it. Since the measure changes nothing about the Colorado tax code save the income tax rate itself, all individuals’ tax savings are proportionally equal at .15% of taxable income and 3.3% of the tax they currently owe. A resident earning $100,000 of taxable income in a filing year, for example, will pay $150 less than s/he would adherent to current law.

Business Tax Relief

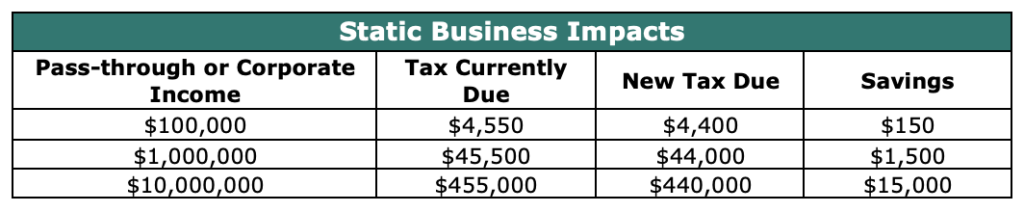

In Colorado, corporate earnings are assessed for income tax at the same rate as are individual earnings. Though its effect upon business taxes is not explicitly addressed in its fiscal impact statement, Proposition #121 would reduce the corporate rate to 4.4%, just as it does the individual. Corporations subject to the Colorado corporate income tax paid $1,051,574,084 in 2021—this amounted to 9% of the state's total income tax collections.

Some businesses do not pay corporate income tax; rather, their owners pay income tax on their firms’ earnings as though they are personal income. According to an estimate by Ernst & Young, these pass-through entities paid $1,000,000,000 (about 6.5% of the state income tax total collections) of Colorado income tax in 2020. Naturally, these businesses (mostly small) will receive the same level of tax cut as individuals and corporations after passage of Proposition #121.

In the context of ongoing cost-of-business increases, Proposition #121 represents a potential small amount of additional relief for struggling Colorado employers. Now that pandemic-era business relief programs have been terminated, proponents of Proposition #121 suggest that a tax break for Colorado businesses could provide some the advantages they require to stay afloat.

TABOR Impacts

Colorado’s Taxpayer’s Bill of Rights (TABOR) caps the amount of revenue that the state government can spend during each fiscal year—when general fund revenue exceeds the limit, the excess is returned to taxpayers in the form of property, sales, and income tax rebates.

[v] According to the latest forecast published by the Colorado Legislative Council Staff, through FY24, general fund revenue is expected to exceed the TABOR cap by more than the total magnitude of Proposition #121’s income tax reduction. This report assumes that there will be no large TABOR refunds after FY24 due to high TABOR cap increases driven by record inflation. This means that, in 2024, 2025, and in any subsequent year of especially high general fund revenue, the effective tax impact of Proposition #121 will be small—income tax savings will be largely offset by reduced TABOR refunds.

Proposition #121, if passed, will broadly have the effects of reducing state revenue and increasing private-sector savings. The tax cut will take effect in 2023 and apply retroactively to the 2022 tax year. As suggested above, current projections indicate that it will also reduce TABOR refunds from the FY23 and FY24 budgets.

The retroactive 2022 tax cut will cause a large tax savings in 2023 and a net tax increase in 2024 due to two years’ worth of tax savings reducing FY23’s TABOR refund obligation (refunded in calendar year 2024). The FY24 TABOR refund offsets most of the tax savings in 2025, when that refund will be distributed, and the impacts stabilize in 2026, when the projected TABOR refunds end.

The portion of the FY22 TABOR refund distributed directly to Coloradans in form of a $750 check, also known as the Colorado Cashback Plan, totaled $2.7 billion.

Dynamic Impacts

The Colorado Legislative Council Staff, as outlined in a January 2020 memo, “does not conduct dynamic modeling, which means that [ballot measure] fiscal notes and other analyses are limited to the scope of legislation’s direct impacts.” Thus, the state’s estimates of Proposition #121’s fiscal impact were generated without consideration of the tax cut’s potential to alter the behaviors of actors within the Colorado economy and without. In this report, CSI uses dynamic modeling to develop a fuller understanding of the measure’s impacts.

Overview of REMI Modeling Sequence

To project the dynamic impacts of Proposition #121, CSI employed the REMI Tax-PI Colorado model.

[vi] The model inputs utilized included the static revenue effects from the proposition’s fiscal impact statement, which are inflated for years after FY24 using REMI’s forecast of personal income growth, and business and individual shares of those revenue effects informed by Colorado Department of Revenue collections data and estimates by Ernst and Young of the share of total Colorado income tax paid by businesses in 2020.

The modeling results follow a framework informed by the logic of the following economic relationship between tax policy and several macroeconomic indicators:

- Tax cuts - Tax cuts stimulate growth by enriching private individuals and thus increase tax revenues somewhat,

- Spending reductions - The static impact of the cuts upon state tax collections overwhelms that positive revenue effect and produces a small adverse growth effect, and

- Total or net impacts - Under the condition of a balanced state budget, the net effects are reflected by the sums of all aforementioned impacts.

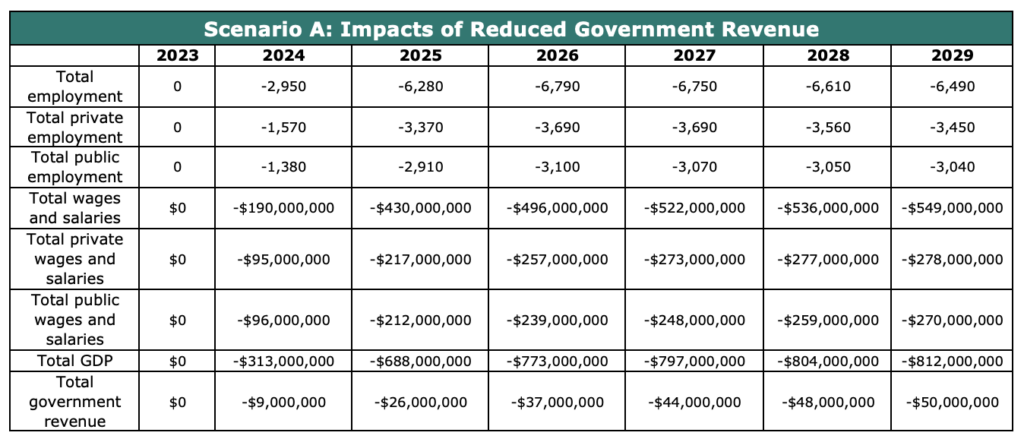

CSI used the REMI model to construct two scenarios which together estimate the range of impacts Proposition #121 will have upon Colorado’s economy. Both scenarios take the same inputs but are configured differently to reflect the ways by which the state government might handle tax revenue decreases. Scenario A is developed according to an assumption that the state government will cut some public jobs in order to reduce its costs accordingly, and Scenario B results from assuming that the state government will cut none of its own jobs or any of its workers’ salaries and instead contract elsewise.

Tax Cuts: Economic Impacts of the Tax Cut Alone

The above set of results presents only the impacts that lower tax payments from taxpayers will have upon the economy. These impacts, which are necessarily and exclusively positive, are caused by the presumptive behaviors of individuals within the economy who retain more wealth available to spend or save.

Spending Reductions: Economic Impacts of Reduced State Government Spending Alone

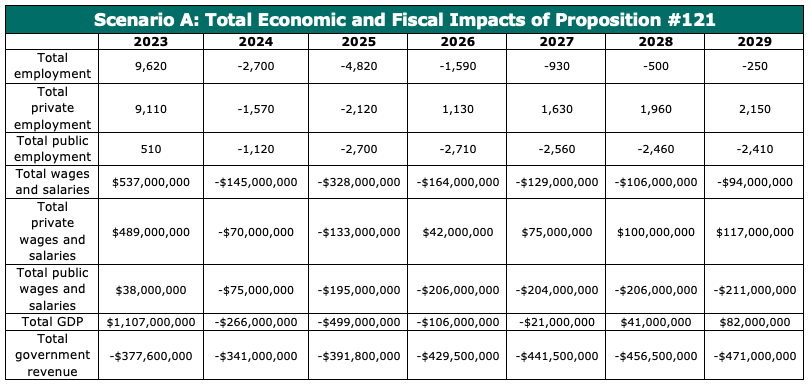

Scenario A: State Spending Reductions with Direct Reductions in State Employment

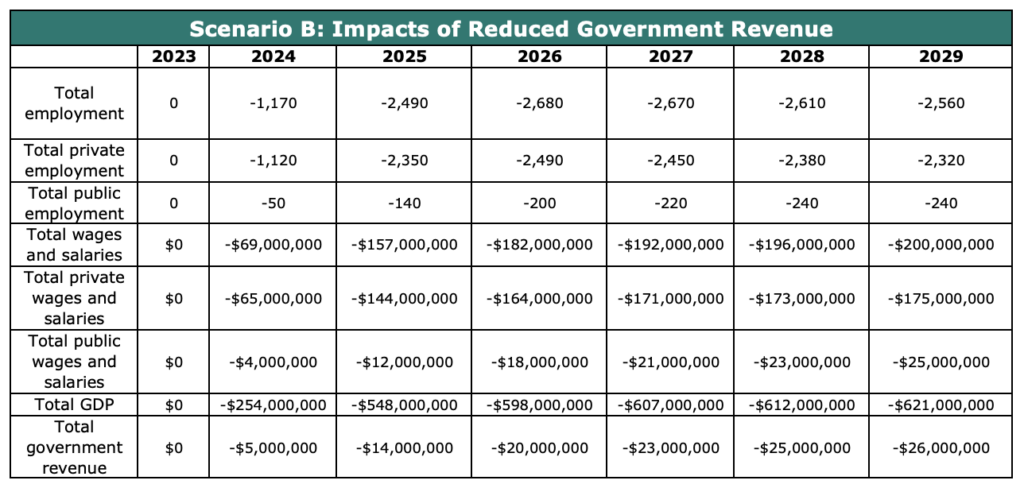

Scenario B: State Spending Reductions without Direct Reductions to State Employment

The two tables above show the modeling estimates in which the constrictive effects of reducing government revenues are isolated. A government with less to spend, all else equal, will spend less and invest less in the economy and cause it to contract. This module was constructed in consideration of both Proposition #121’s fiscal impact statement’s static projections and the dynamic state revenue increase effects of the process established in the prior step.

Net Impacts

Scenario A: Tax Cuts and State Spending Reductions with Direct Reductions in State Employment

Scenario B: Tax Cuts and State Spending Reductions without Reductions in State Employment

The previous two tables show Tax-PI model simulation results in which, for each scenario, the modeling inputs of the tax cuts and spending reductions are combined. Thus, they display the whole of Proposition #121’s economic impact and fiscal impact. The results suggest that, although the reduction in state spending will dampen the positive impacts upon the private sector, total private sector employment, wages, and output remain improved. The measure’s true effect will, to a degree, depend upon how the state government chooses to reduce spending.

Conclusion

Proposition #121 will appear before Colorado voters during a time of protracted economic recovery and diminishing affordability. Its impacts will be considered in the context of record inflation, regulatory growth, and the largest state budget in Colorado history. Given the permanence of the tax cut, voters should also consider its long-term implications, which could occur under vastly different economic circumstances.

Though the static fiscal estimates illustrate the relative size of the change in tax revenue, the dynamic economic modeling described in this report should help to better understand how the impacts will manifest throughout the economy. State spending reductions will eventually be required to accommodate the tax cut, but less state-government revenue means more savings for individuals and businesses—this translates to more jobs, higher incomes, and higher economic output.

© 2022 Common Sense Institute

[i] https://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/filings/2021-2022/31Final.pdf

[ii] https://leg.colorado.gov/sites/default/files/initiatives/2022%252331FIS_00.pdf

[iii] https://leg.colorado.gov/agencies/legislative-council-staff/individual-income-tax%C2%A0

[iv] https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-a-comparison-for-businesses

[v] https://leg.colorado.gov/agencies/legislative-council-staff/tabor

[vi] https://www.remi.com/model/tax-pi/